All Publications

Showing 109–120 of 541 results

-

2022

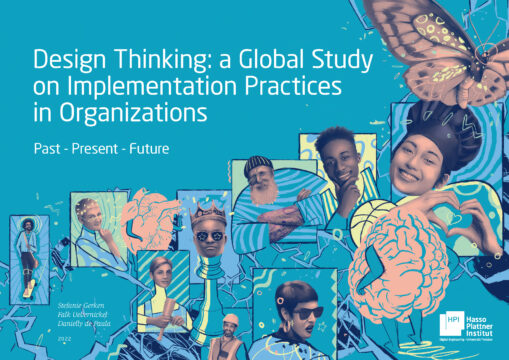

2022Design Thinking: a Global Study on Implementation Practices

40,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

-

2022

2022Der Amicus Curiae im deutsch-französischen Vergleich

Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

-

2022

2022The North Atlantic Treaty Organization and cross-cultural competence

13,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

-

2022

2022Alexander von Humboldt im Netz ; 23 (2022) 44

30,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

-

2022

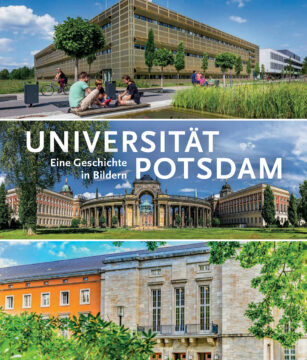

2022Universität Potsdam

20,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

-

2022

2022MenschenRechtsMagazin ; 27 (2022) 1

9,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

-

2022

2022Von Salben und Skalpellen: Heilkunst in der römischen Antike

Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

-

2022

2022Konzeption einer Unterrichtssequenz zur Erzähltechnik in Caesars

Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

-

2022

2022Transitional Justice

10,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

-

2022

2022Unbemannte Schiffe im Internationalen Seerecht

15,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

-

2022

2022Hier geblieben

34,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

-

2021

2021Alexander von Humboldt im Netz ; 22 (2021) 43

25,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Contact

Potsdam University Library

University Press

Am Neuen Palais 10

14476 Potsdam

Germany

verlag@uni-potsdam.de

0331 977-2094

0331 977-2292