thersites

thersites is an international open access journal for innovative transdisciplinary classical studies edited by Annemarie Ambühl, Filippo Carlà-Uhink, Christian Rollinger and Christine Walde.

- thersites expands classical reception

studies by publishing original scholarship free of charge and by

reflecting on Greco-Roman antiquity as present phenomenon and diachronic

culture that is part of today’s transcultural and highly diverse world.

Antiquity, in our understanding, does not merely belong to the past,

but is always experienced and engaged in the present. - thersites contributes to the critical

review on methods, theories, approaches and subjects in classical

scholarship, which currently seems to be awkwardly divided between

traditional perspectives and cultural turns. - thersites brings together scholars,

writers, essayists, artists and all kinds of agents in the culture

industry to get a better understanding of how antiquity constitutes a

part of today’s culture and (trans-)forms our present.

In order to subscribe to a journal, please contact us via our contact form.

Contact formOrder single issue

Showing all 2 results

-

2024

2024thersites 18

Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

Read more -

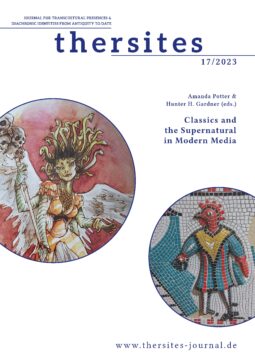

2023

2023thersites 17

Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

Read more

Contact

Potsdam University Library

University Press

Am Neuen Palais 10

14476 Potsdam

Germany

verlag@uni-potsdam.de

0331 977-2094

0331 977-2292