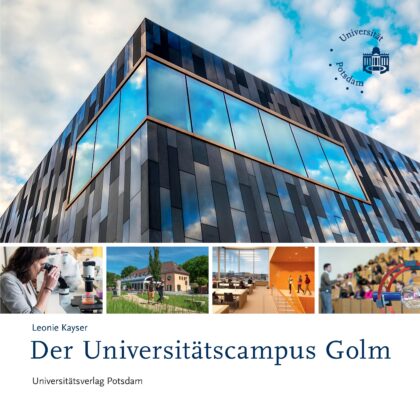

gestellt an Leonie Kayser

ISBN: 978-3-86956-451-7

88 pages

Release year 2019

9,50 €

Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally. zzgl. Versandkosten

Recommended Books

-

2024

2024Ottmar Ette, Haiyan Ren, Alberto Gómez Gutiérrez, Lou Fang, Ulrich Päßler, Walter Schellhas

Alexander von Humboldt im Netz ; 25 (2024) 49

19,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2006

2006Arbeitskreis Militär und Gesellschaft in der Frühen Neuzeit e.V.

Militär und Gesellschaft in der frühen Neuzeit ; 10 (2006) 1

7,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

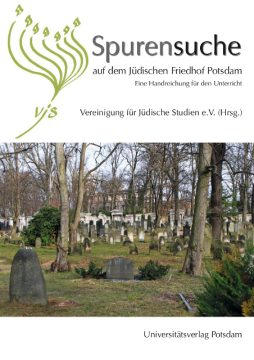

2017

2017Vereinigung für Jüdische Studien e. V. (Hrsg.)

Spurensuche auf dem Jüdischen Friedhof Potsdam

14,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2021

2021Alexandra Forst, Nicola Hömke, Meike Rühl, Jon Albers, Filippo Carlà-Uhink, Jan Reimann, Holger Sonnabend

Potsdamer Lateintage 2018–2020

13,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart

Contact

Potsdam University Library

University Press

Am Neuen Palais 10

14476 Potsdam

Germany

verlag@uni-potsdam.de

0331 977-2094

0331 977-2292