Ottmar Ette

Books by this author

Showing 1–12 of 44 results

-

2025

2025Alexander von Humboldt im Netz ; 26 (2025) 50

44,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2024

2024Alexander von Humboldt im Netz ; 25 (2024) 49

19,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2024

2024Alexander von Humboldt im Netz ; 25 (2024) 48

22,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2023

2023Alexander von Humboldt im Netz ; 23 (2022) 45

21,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2020

2020Alexander von Humboldt im Netz ; 21 (2020) 41

24,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2019

2019Alexander von Humboldt im Netz ; 20 (2019) 38

10,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2019

2019Alexander von Humboldt im Netz ; 19 (2018) 37

20,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2019

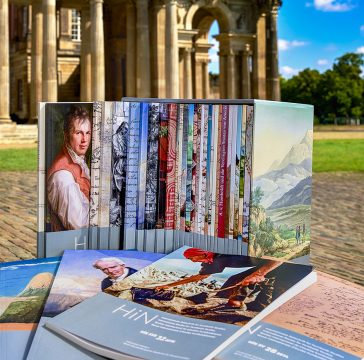

2019HiN – Alexander von Humboldt im Netz

550,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2019

2019Alexander von Humboldt im Netz ; 17 (2016) 32

16,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2019

2019Alexander von Humboldt im Netz ; 17 (2016) 33

18,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2019

2019Alexander von Humboldt im Netz ; 16 (2015) 31

27,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2018

2018Alexander von Humboldt im Netz ; 2 (2001) 2

12,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart

Contact

Potsdam University Library

University Press

Am Neuen Palais 10

14476 Potsdam

Germany

verlag@uni-potsdam.de

0331 977-2094

0331 977-2292