Annemarie Ambühl , Anastasia Bakogianni, Wolfram Brinker, Pia Düvel, Ulrike Ehmig, Jens Fischer, Jonas Konstantin Mach, Mattia Mancini, Alicia Matz, Jeremiah McCall, David Serrano Lozano, Luis Unceta Gómez, Eva Werner

180 pages

Release year 2024

Series: thersites , 18

Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

Recommended Books

-

2024

2024Marcia C. Schenck, Valeria Borrero-Ramos, Dimitra Keramida, Nishitha Mandava, Somapti Sarkar, Veronika Wiemker, Anaïs C. Yolka, Leslie Carr-Riegel, Iurii Rudnev, James A. V. Burnard, Lasse Gräf, Lasse J. Maerz, Valentina Meyer-Oldenburg Torres, Carmen Vázquez Pérez

Border-Crossing

Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

Read more -

2012

2012Sven Petersen, Eberhard Birk, Stefan Droste, Frederic Groß, Bernhard R. Kroener, Markus Meumann, Oleg Rusakovskiy, Ojars Sparitis, Shinko Taniguchi

Militär und Gesellschaft in der Frühen Neuzeit ; 16 (2012) 1

7,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

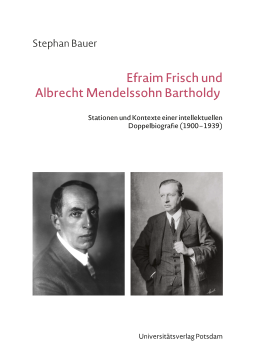

2024

2024Efraim Frisch und Albrecht Mendelssohn Bartholdy

47,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2023

2023Filippo Carlà-Uhink, Eike Faber, Marc Tipold, Karina Jung, Désiré Nahon, Tom Dera, Richard Schiffner, Moritz Radecke, Magnus Crone, Ricardo Rinne, Celina Otto, Sabeth Offergeld, Elisa Cazorla, Neele Chill, Nina Mindt

Sardinien

26,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart

Contact

Potsdam University Library

University Press

Am Neuen Palais 10

14476 Potsdam

Germany

verlag@uni-potsdam.de

0331 977-2094

0331 977-2292