Annemarie Ambühl , Anastasia Bakogianni, Wolfram Brinker, Pia Düvel, Ulrike Ehmig, Jens Fischer, Jonas Konstantin Mach, Mattia Mancini, Alicia Matz, Jeremiah McCall, David Serrano Lozano, Luis Unceta Gómez, Eva Werner

180 pages

Release year 2024

Series: thersites , 18

Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

Recommended Books

-

2018

2018Achim Landwehr, Anke Fischer-Kattner, Stefan Hanß, Kai Lohsträter, Sven Petersen, Anja Schumann

Militär und Zeit in der Frühen Neuzeit

9,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2025

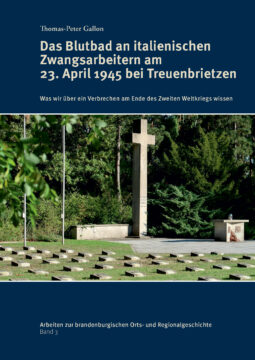

2025Das Blutbad an italienischen Zwangsarbeitern am 23. April 1945 bei Treuenbrietzen

16,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2010

2010Die Herausbildung moderner Strukturen in Gesellschaft und Staat der Frühen Neuzeit

22,50 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart -

2016

2016Juristische Fakultät, Wirtschafts- und Sozialwissenschaftliche Fakultät

Der Universitätscampus Griebnitzsee

16,00 €Non-taxable transaction according to § 1 (1) UStG/VAT Act in combination with § 2 (3) UStG/VAT Act a. F. Providing this service, the University of Potsdam does not constitute a Betrieb gewerblicher Art/Commercial Institution according to § 1 (1) No. 6 or § 4 KStG/Corporate Tax Act. If the legal characterization of our business is changed to a commercial institution subsequently, we reserve the right to invoice VAT additionally.

zzgl. Versandkosten

Add to cart

Contact

Potsdam University Library

University Press

Am Neuen Palais 10

14476 Potsdam

Germany

verlag@uni-potsdam.de

0331 977-2094

0331 977-2292